san francisco payroll tax repeal

The proposed gross receipts tax rates for all industries are shown in the table below. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

Why San Francisco S Big Business Tax For Homeless Relief Succeeded After Seattle S Crumbled Geekwire

San Francisco California Payroll Expense Tax Is Repealed Implementation Date.

. The fees will range from 75 to a maximum of 35000 for companies with payroll expenses over 40M. From imposing a single payroll tax to adding a gross receipts tax on. Gross Receipts Tax and Payroll Expense Tax.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Apply to waive or cancel tax penalties and fees including late payment penalties. As weve reported before San Francisco is one of the only cities in the nation that has a payroll tax.

Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. San Francisco Business and Tax Regulations Code Annotations Off Follow Changes Share Download Bookmark Print Editors note. If your business stops operating you must tell the City.

Businesses that operate only an administrative office in San Francisco currently pay a 14 payroll tax. To continue reading register for free access now. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City.

Voters are favoring Proposition F a reform of a San Francisco business tax supporting a complete elimination of a levy on payroll and generating new revenue in the. Proposition F fully repeals the Payroll Expense. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are.

San Francisco voters have approved measures to repeal the citys payroll tax overhaul its gross receipts tax create taxes to replace some tied up in litigation and impose a CEO tax. Lean more on how to submit these installments online to. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes.

The fees range from 15000 to 35000 for companies with payroll expenses over. The Payroll Tax is a tax on the payroll expense of persons and associations engaging in business in San Francisco. Article 12-A the Payroll Expense Tax Ordinance was.

If you received a letter from the Citys. What to expect for tax season The Gross Receipts Tax and Business Registration Fees Ordinance or simply Ordinance was approved by San Francisco voters on November 6. But what is even more unique that a lot of local reporters miss.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. Business Tax Overhaul. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24.

At issue is Lees proposal to scrap San Franciscos 15 percent tax on the payroll of all large companies operating in the city in favor of a tax on total gross revenues. 5 The current Payroll. Payroll Expense Tax.

The ordinance became effective October 1 1970. The ordinance imposes a. Tax is best although payroll taxthe type of business tax currently levied by San Franciscois uncommon and may have strong negative effects on wage and employment levels.

For transfers within the 10 million to 25 million tier Proposition I would increase the Transfer Tax to 2750 per 500 of value or consideration or 55 percent. Does This Tax Drive Businesses From San Francisco.

Potential New Corporate Taxes Could Thwart The Innovation Economy

Tax Reform Faqs Top Questions About The New Tax Law Bdo

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Livable City S November 2020 Election Recommendations Livable City

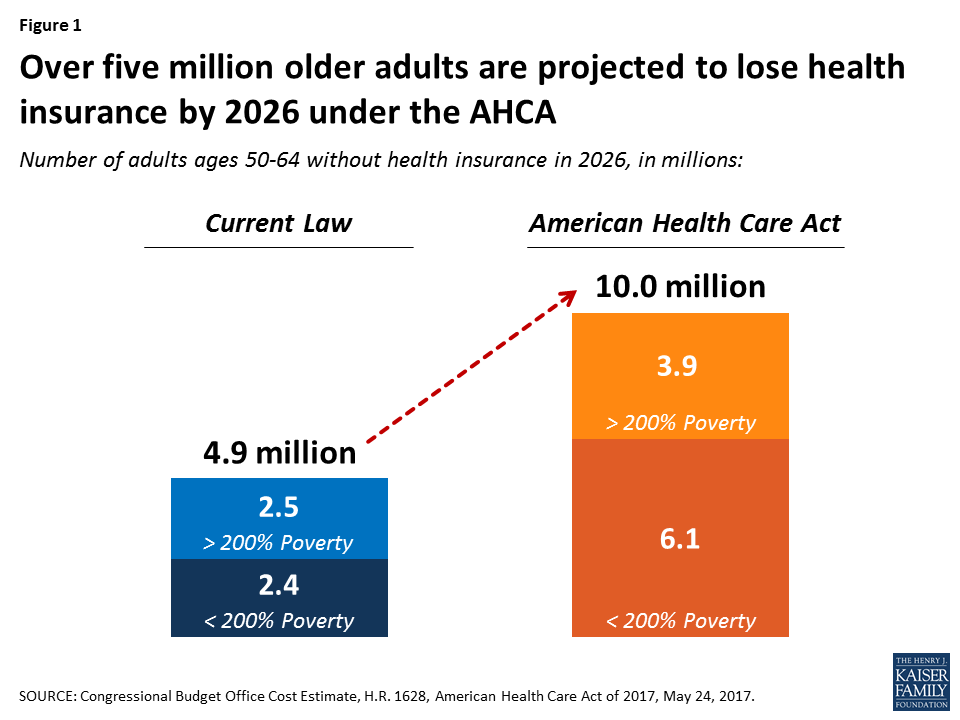

How Aca Repeal And Replace Proposals Could Affect Coverage And Premiums For Older Adults Issue Brief 9038 Kff

Tax Reform Faqs Top Questions About The New Tax Law Bdo

The Cares Act Resources Benningfield Financial Advisors Llc

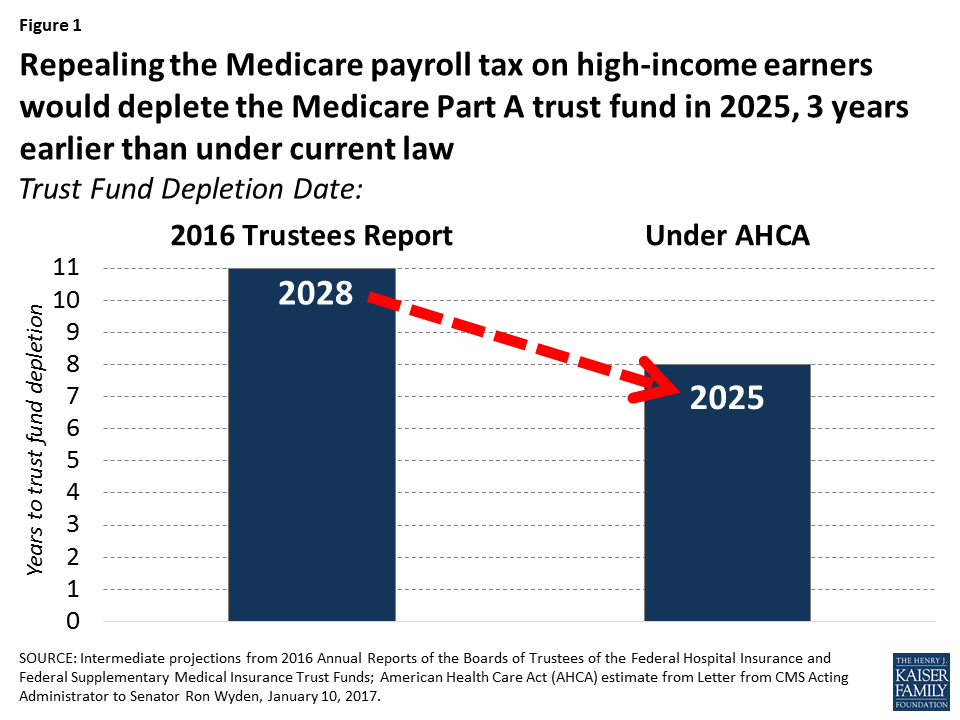

What Are The Implications For Medicare Of The American Health Care Act Issue Brief 8989 Kff

What The Cadillac Tax Accomplishes And What Could Be Lost In Repeal Wsj

/GettyImages-547124491-1--5756b2055f9b5892e8a8fd30.jpg)

Taxes And The Election What Changed

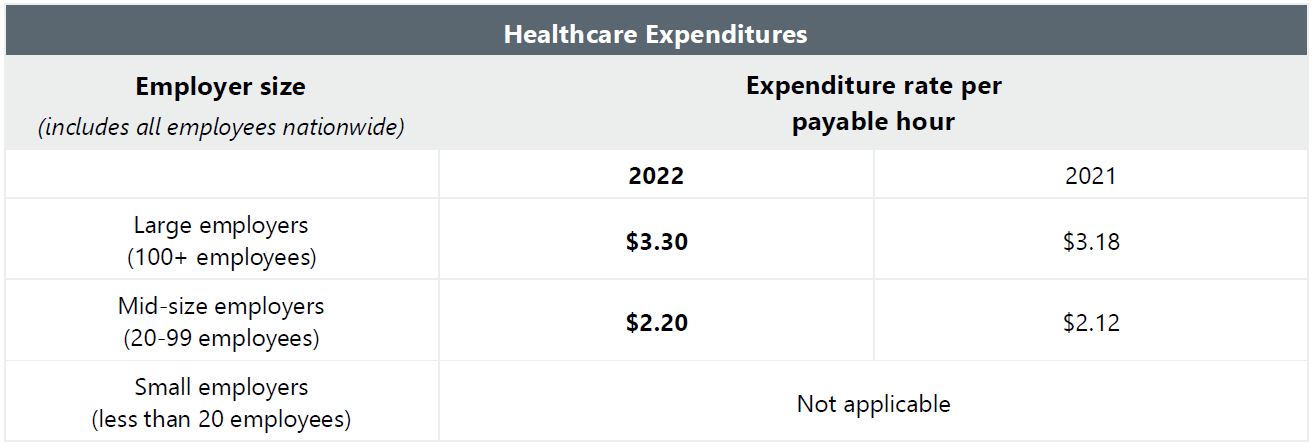

San Francisco Ups Hcso Rates Clarifies Sort Of Coverage Of Teleworkers

San Francisco Set To Begin 2021 With Gross Receipts Tax Increase New Levy On Overpaid Executives To Take Effect In 2022 Andersen

As Silicon Valley Looks To Tax Tech San Francisco Has Lightened Its Load

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

San Francisco S New Local Tax Effective In 2022

Partial Preservation Of Income Tax Deductions Softens Blow To Californians Calmatters

Will San Francisco S Business Tax For Homeless Relief Succeed Where Seattle S Failed This Tech Billionaire Is Fighting For It Geekwire

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj