snohomish property tax due date

Learn all about Snohomish County real estate tax. First half of property-tax bill comes due April 30.

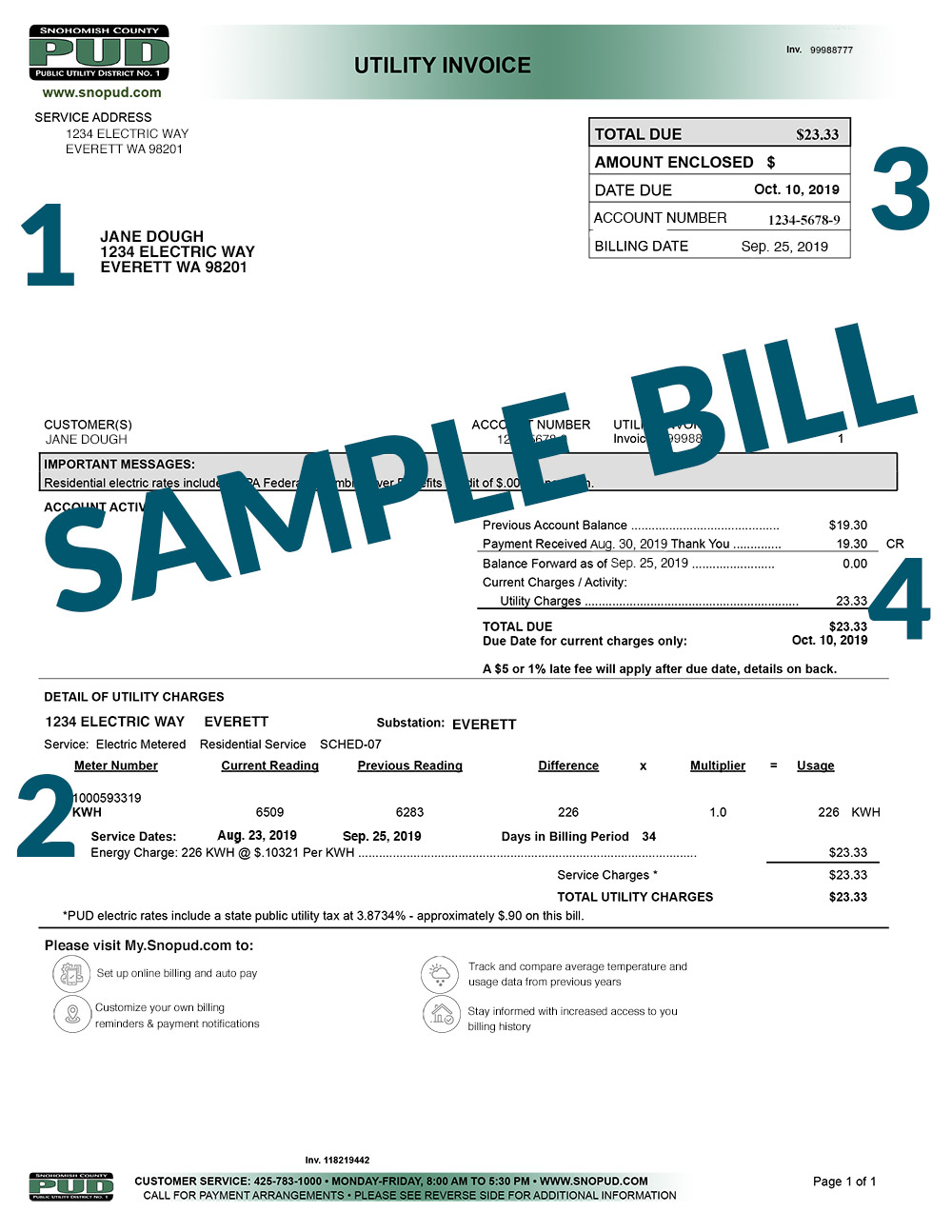

My Billing Statement Snohomish County Pud

16 rows Property taxes can be paid on or after this date.

. One silver lining on the dark cloud of Washington State Governor Inslees emergency declaration was that it empowered the elected county treasurers to delay the due date for paying property taxes. Deadline will now be June 1 2020. Please call 425-388-3606 if you would like to make payments on your DELINQUENT property Taxes.

When summed up the property tax burden all owners shoulder is created. See your tax bill for details. If the 15th falls on a weekend or holiday due date is the next business day.

State Sales and Use Tax. Search for Property Taxes. Based on that 089 rate Snohomish County homeowners can expect to pay an average of 3009 a year in property.

It could have been better. In case you missed it the link opens in a new tab of your browser. Local City County Sales and Use Tax.

Homeowners pay 986 per 1000 of home value or about 099 of home value. Second half taxes are due October 31. Please remember the due date requirements for property taxes and allow adequate time for your payment to process through your financial institution.

Snohomish County Treasurer 425-388-3366. Pay property taxes--We offer several options for paying your property taxes including in person through the mail or online. If paying after the listed due date additional amounts will be owed and billed.

Government Websites by CivicPlus. This executive order only applies to residents who pay their individual and commercial property taxes themselves rather than through their mortgage le. What is the property tax rate in Snohomish County.

RCW 84560208 is the statutory authority for these actions and is detailed below. The Pierce and Snohomish county treasurers are also maintaining this deadline in their. The average home value in Washington is 310277 and Washington homeowners pay an average of 3059 in property taxes.

303 Cayuga Rd Suite 150 Cheektowaga NY 14225 Email. No interest will be charged on payments received by that date. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June. For most homeowners that pay their taxes with their mortgage payment however there wont be any relief. Whether you are already a resident or just considering moving to Snohomish County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Accounts with delinquent taxes must first be approved by the Snohomish County Treasurers Office. Are Dental Implants Tax Deductible In Ireland. Make a one time payment below using your Parcel ID OR use the Create an account link to make future payments easier.

This Executive Order only applies to residents who pay their. The Snohomish County treasurer has switched to a new vendor to offer less expensive online payments. The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate of 089 of property value.

Skip to Main Content. EVERETT Snohomish County March 30 2020 Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June 1 2020. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related.

City tax rates and information including sales tax use taxes lodging tax real estate excise tax and utility tax. First half taxes are due April 30. Snohomish County Government 3000 Rockefeller Avenue Everett WA 98201 Phone.

Pay your taxes in full by November 15 or make partial payments with further installments due in February and May. Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June 1. Spokane County has extended the deadline to June 15 th 2020.

The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. King Pierce and Snohomish County have extended the payment due date for property taxes to June 1 st 2020. Snohomish WA 98291-1589 Utility Payments PO.

Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. Restaurants In Matthews Nc That Deliver. During a state of emergency declared under RCW 430601012 the county.

Using this service you can view and pay them online. Snohomish County collects on average 089 of a propertys assessed fair market value as property tax. Restaurants In Erie County Lawsuit.

Opry Mills Breakfast Restaurants. If you are planning to buy a home in Washington and want to understand how much your property tax bill could potentially cost check out our. Snohomish Property Tax Due Date.

Snohomish County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. Majestic Life Church Service Times. After that date interest charges and penalties will be added to the tax bill.

Please note that 1st Half Taxes are Due April 30th and 2nd Half Taxes are Due October 31st. In this mainly budgetary function county and local public leaders estimate annual spending. Please refer to the back of your tax statement to determine eligibility or you may contact the Snohomish County Assessors Office at 425-388-3540 for additional information.

Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11 and slightly below the Washington statewide average of 092. Snohomish County has one of the highest median property taxes in the United States and is ranked 155th of the 3143 counties in order of. Snohomish WA 98291-1589 Utility Payments PO.

King County property owners who pay their property taxes themselves rather than through a mortgage lender have until Monday November 2 to pay the second half of their 2020 bill.

Snohomish County Extends Deadline For Individual Property Taxpayers To June 1 My Edmonds News

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

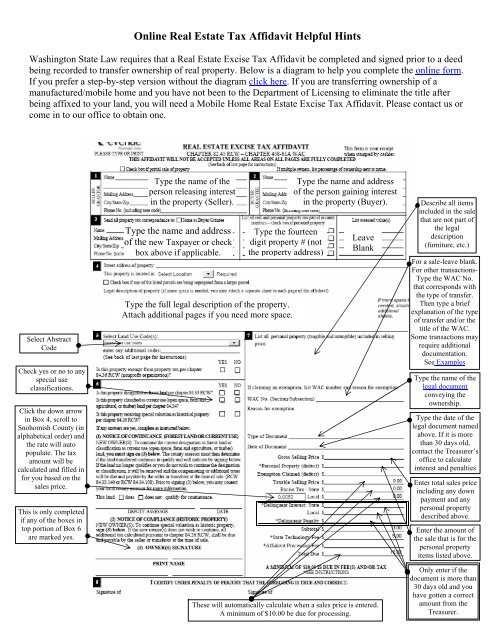

Online Real Estate Tax Affidavit Helpful Hints Snohomish County

Property Taxes And Assessments Snohomish County Wa Official Website

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Snohomish County Treasurer Payments

Workforce Snohomish Posts Facebook

How To Read Your Property Tax Statement Snohomish County Wa Official Website

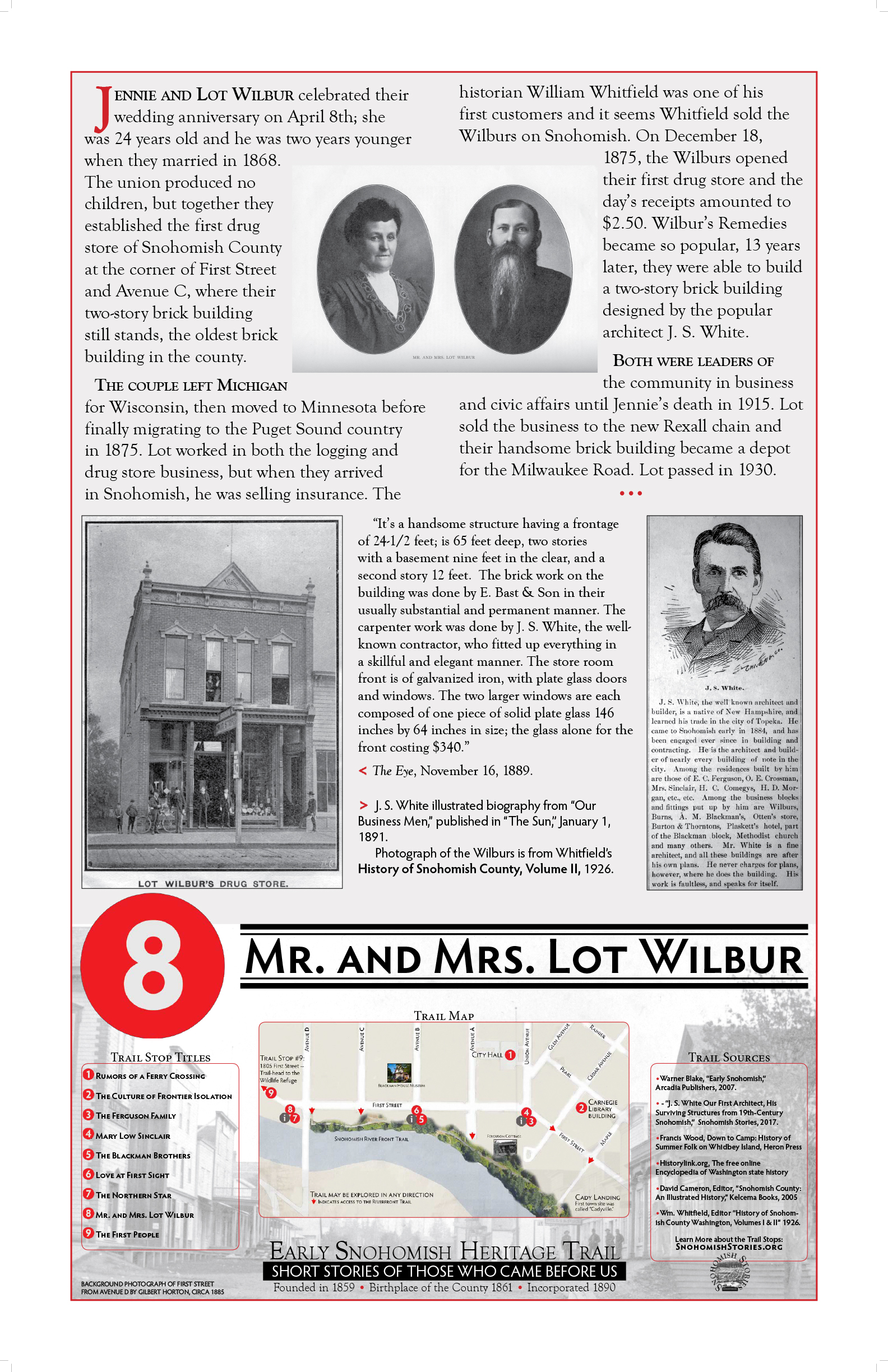

Snohomish Wa History Archives Snohomish Stories

Commissioner Bar Poll Snohomish County Bar Association

Property Tax Interest Snohomish County Wa Official Website

![]()

Updated 2019 General Election Results For Snohomish County Heraldnet Com

Property Tax Interest Snohomish County Wa Official Website

Snohomish Country Tribune Newspapers Obituaries

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Individual Property Tax Deadline Extended To June 1 Lynnwood Times